UK VAT Calculator – Add or Remove VAT Instantly

This free VAT calculator lets you add or remove VAT from any amount using UK rates. Type the amount, pick the VAT rate, and get instant results.

You can:

- Add 20% VAT to a base price

- Remove VAT from a total price

- Change VAT rate to 5% or 0%

- Calculate VAT backwards

- Get net, VAT, and gross values

What is VAT?

VAT means Value Added Tax charged on goods and services sold in the United Kingdom. Businesses add VAT to the price when they sell items or services. The customer pays this tax as part of the total price.

The business then sends the VAT to HM Revenue and Customs. VAT started in the UK in 1973. It replaced the old purchase tax system. VAT now brings in a large part of the government’s income.

Who needs to pay VAT?

Businesses in the UK must pay VAT if their yearly turnover is more than £90,000. This rule means they must register for VAT and charge it on all taxable sales. Some businesses with lower turnover can also register if they want to.

Once registered, a business collects VAT from its customers and sends it to HMRC. VAT rules apply to most goods and services sold in the UK and the Isle of Man. People who buy these items pay VAT as part of the total price.

What are the VAT rates in the UK?

The UK uses three VAT rates based on the type of item or service. Some goods are exempt and do not have VAT.

|

Rate Type |

Rate |

Examples |

|---|---|---|

|

Standard Rate |

20% |

Electronics, furniture, clothing, services |

|

Reduced Rate |

5% |

Home energy, children’s car seats, mobility aids |

|

Zero Rate |

0% |

Food, books, newspapers, children’s clothing |

|

Exempt |

None |

Postage, education, insurance, health services |

How to Calculate VAT?

To calculate VAT, use the rate and apply it to the price. If you want to add VAT, multiply the price by 1 plus the VAT rate. If you want to remove VAT, divide the total by 1 plus the VAT rate. These steps work for standard, reduced, or zero rates.

Adding VAT

To add VAT, multiply the base price by 1.2 for the 20 percent rate.

Example: A product costs £100. Multiply £100 by 1.2. The total price with VAT is £120. The VAT added is £20.

Deducting VAT

To remove VAT, divide the total price by 1.2 for the 20 percent rate.

Example: A product costs £120. Divide £120 by 1.2. The base price is £100. The VAT removed is £20.

Calculate VAT from gross

To find VAT from a gross amount, divide by 1.2 and subtract the result from the total.

Example: £240 divided by 1.2 is £200. VAT is £240 minus £200, which is £40.

Reverse VAT calculator

A reverse VAT calculator finds the price before VAT was added. Use this by entering the full price and dividing by 1 plus the VAT rate. This shows the original price and the VAT included.

5% and 0% VAT examples

For a 5 percent rate, multiply by 1.05 to add VAT or divide by 1.05 to remove it.

Example: A price of £100 becomes £105 with 5 percent VAT added.

For zero rate, VAT is zero, and the price stays the same.

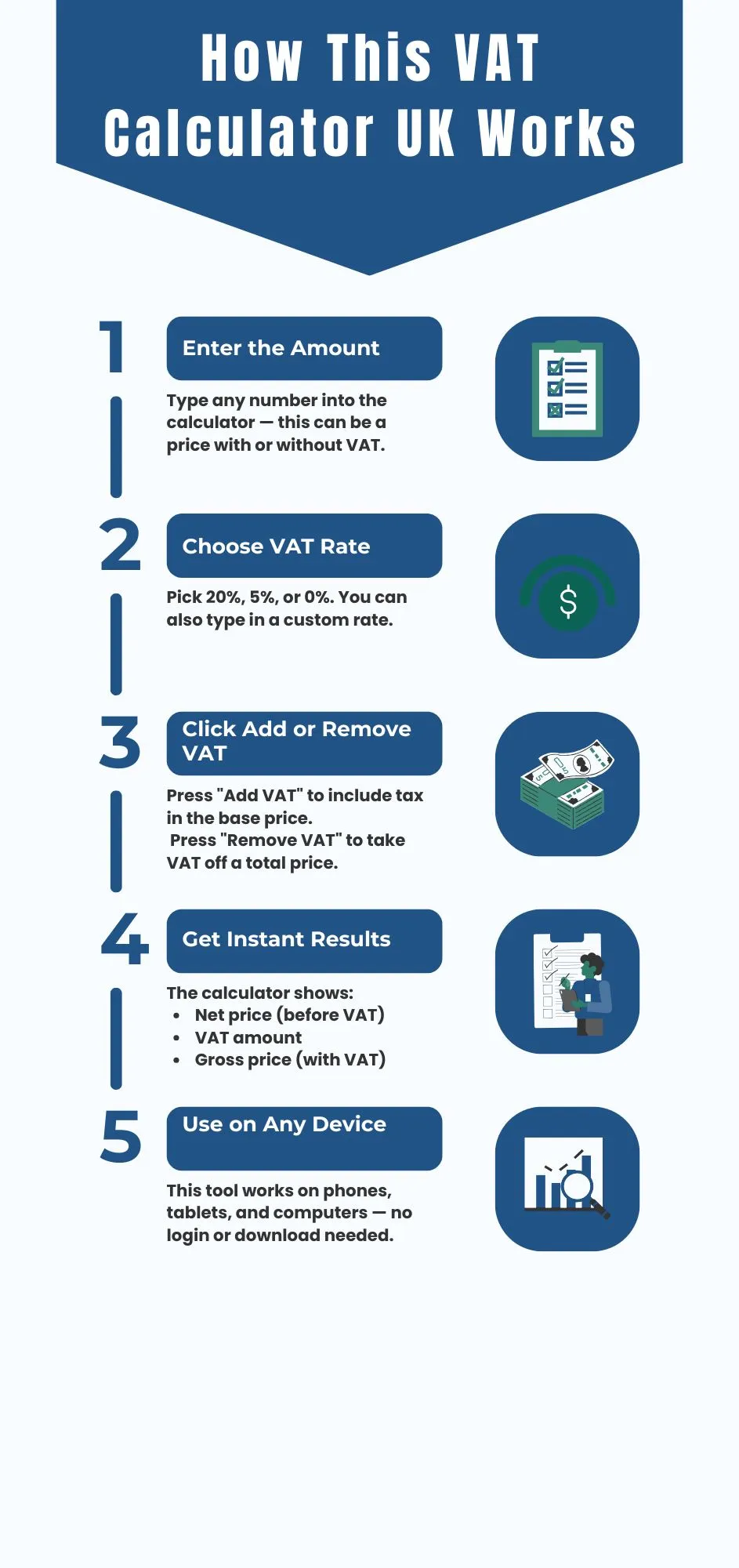

How does this VAT calculator work?

This VAT calculator works by using the amount you enter and the VAT rate you choose. You type a number, pick a rate, and press add VAT or remove VAT. The result shows the net amount, VAT amount, and gross total.

The tool updates instantly and works with the standard 20 percent rate, the reduced 5 percent rate, or a zero rate. It also lets you change the rate if needed.

Add VAT feature

To add VAT, enter a price without VAT and press add VAT. The calculator multiplies the price by 1 plus the VAT rate. The result shows the new total and the VAT added.

Remove VAT feature

To remove VAT, enter a total price and press remove VAT. The calculator divides the amount by 1 plus the VAT rate. It shows the base price and the VAT taken off.

Change VAT rate manually

You can type in a different VAT rate if needed. This is helpful if you deal with foreign rates or special categories like 5 percent VAT. The tool will still work the same way.

Use on mobile or desktop

This calculator works on phones, tablets, and computers. You can use it without logging in or downloading anything. It loads fast and gives answers in seconds.

Benefits of using a VAT calculator

A VAT calculator helps you get the right numbers fast. It saves time by doing all the steps for you. You do not need to remember formulas or use a pen and paper. The calculator gives clear results, showing the VAT, net amount, and total price.

It also lowers the chance of mistakes. Manual VAT calculations can lead to wrong totals. This tool always uses the right method for adding or removing VAT.

The calculator works for all types of users. You can use it if you are a shop owner, freelancer, builder, or customer. It helps with invoices, quotes, and receipts. You can check prices with or without VAT in just seconds.

What is the Formula for Calculating VAT Manually?

The formula for calculating VAT is

To find the VAT amount:

VAT Amount = Original Price × VAT rate / 100

- The original Price is the price before VAT is added.

- VAT Rate is the percentage rate of VAT.

To find the total price including VAT:

Total Price = Original Price + VAT Amount

Alternatively, you can combine the two steps:

Total Price = Original Price × (1+VAT Rate/100)

To find the original price before VAT (if you know the total price and VAT rate):

Original Price=Total Price / 1+ VAT Rate / 100

Total Price is the price after VAT has been added

How to Add VAT to the price?

Adding VAT to a price is simple, when you need to add VAT to a price, use the following calculation:

suppose the base price of the product is £100, and the VAT rate is 20%

VAT Amount = £100 × 0.20 = £20

Total Price with VAT will be: Total Price = £100 + £20 = £120

Example

If a shopkeeper sells a book with the basic price of £50 and the VAT rate is 20% then

VAT amount = £50 × 0.20 = £10

Total price = £50 + £10= £60

£60 is the price of the book including 20% of VAT.

How to Remove VAT from the Price?

When you need to remove VAT from the total price to find out the basic price, use the following calculation

Suppose the total price of a product Is £120 including 20% VAT

Calculate Base Price:

Base Price = £120/1+ 0.20 = £120/1.20 = £100

VAT Amount = £120 − £100 = £20

Example

If a shopkeeper sale a shirt at the price of £96 including 20% VAT

Base Price for shirt = £96/1+0.20 = £96/1.20 = £80

VAT amount: £96 − £80 = £16

The base price of the shirt is £80, and the VAT is £16.

What is VAT Inclusive?

VAT inclusive means that VAT is also added to the price.

How to calculate VAT inclusive?

You can calculate VAT inclusive by following this simple calculation

if the total price of a product Is £120 including 20% VAT

Total Price of product = £120/1+ 0.20 = £120/1.20 = £100

VAT Amount = £120 − £100 = £20

Example:

A shopkeeper sells a pair of shoes for £120, including 20% VAT.

Total Price of shoes = £120/1+ 0.20 = £120/1.20 = £100

VAT Amount = £120 − £100 = £20

The basic price of shoes is £100 with 20% included in the total £120.

What is VAT Exclusive?

VAT exclusive means that VAT is not included yet, it will be added at the top of the basic price.

How to Calculate VAT Exclusive?

If the product price is £100 and the VAT rate is 20%.

Total price = • £100 × 1.20 = £120

VAT amount = £120 − £100 = £20

Example:

If the shopkeeper sells a pent, with a basic price of £30, and the VAT rate is 20%.

Total Price = £30 × 1.20 = £36

VAT amount = £36 − £30 = £6

The total price of pent is £36 which includes £6 VAT added to the base price of £30.

How to Calculate VAT Reverse?

To calculate reverse VAT charge or calculate VAT backwards follow this simple VAT reverse calculation, take the VAT rate, and divide it by 100.

Example:

A shopkeeper sells a bed for a total of £150, and the VAT rate is 20%

Basic price = £150/1+0.20 = £150/1.20 = £125

VAT amount = £150 – £125 = £25

The basic price of the bed is £125 and the VAT is £25 which makes the total price of £150.

How to calculate VAT from gross price?

You can calculate VAT from gross price by dividing the value of the VAT rate by 100.

Example:

A shopkeeper sells a table for a total of £200, and the VAT rate is 20%

Basic price = £200/1.20 = £166

VAT amount = £200 – £166 = £34

The base price of the table is £166, VAT amount is £34, making the total price £200.

Conclusion

Understanding how to use the VAT calculator UK is necessary if you want to manage your finances effectively. Using our VAT calculation tool you can easily add or remove VAT, work with VAT inclusive and exclusive prices, and calculate VAT backward within a few clicks and accurate results. Try out our VAT Calculator UK tool for free. If you need more help or have any questions, we’re here for you!

FAQs

To calculate VAT, multiply the price by the VAT rate divided by 100. For example, £100 × 20% = £20.

How do I take VAT off a price?

To remove VAT, divide the total by 1.2 if the rate is 20%. The result is the base price without VAT.

VAT inclusive means the total price already includes VAT.

VAT exclusive means VAT is not yet included in the listed price.

Divide the gross amount by 1 plus the VAT rate. For 20%, divide by 1.2.

Yes. Enter the total price and divide it by 1 plus the VAT rate.

Yes. The calculator is free and works with 20%, 5%, and 0% VAT rates.

You must register for VAT if your yearly turnover is over £90,000.